Top 5 CFD brokers in comparison

Seit dem Krypto-Boom interessieren sich immer mehr Menschen für den Online-Handel mit Aktien, Indizes, Optionen und eben auch Kryptowährungen. Während der Kauf echter Aktien mit einigen Komplikationen verbunden ist, erlaubt der CFDs trading einen schnellen und unkomplizierten Einstieg in die Welt des Tradens. Wir präsentieren in diesem Beitrag die Top 5 CFD Brokers und klären dich über den Handel mit CFDs (Contracts for Difference) auf.

Seit dem Krypto-Boom interessieren sich immer mehr Menschen für den Online-Handel mit Aktien, Indizes, Optionen und eben auch Kryptowährungen. Während der Kauf echter Aktien mit einigen Komplikationen verbunden ist, erlaubt der CFDs trading einen schnellen und unkomplizierten Einstieg in die Welt des Tradens. Wir präsentieren in diesem Beitrag die Top 5 CFD Brokers und klären dich über den Handel mit CFDs (Contracts for Difference) auf.

To CFD Broker Comparison Table

Content

Top 3 recommendations: CFD Broker

1. Plus500

![]() At Plus500 handelt es sich um eine der größten CFD-Handelsplattformen der Welt. Seit der Gründung im Jahr 2008 hat sich das Portal für den CFD-Handel mit Aktien, Indizes, Devisen (und mittlerweile auch Kryptowährungen) stetig weiterentwickelt.

At Plus500 handelt es sich um eine der größten CFD-Handelsplattformen der Welt. Seit der Gründung im Jahr 2008 hat sich das Portal für den CFD-Handel mit Aktien, Indizes, Devisen (und mittlerweile auch Kryptowährungen) stetig weiterentwickelt.

Neben der Web-Plattform (Plus500 WebTrader) gibt es auch Apps für die größten Smartphone-Betriebssysteme. Als Trader kann man somit nicht nur am PC handeln – auch der Handel von unterwegs ist jederzeit möglich.

Mittlerweile kann man in mehr als 2.000 Märkten handeln. Die Optionen reichen dabei von Rohstofen über Indizes, Kryptowährungen, bis hin zu einzelnen Aktien.

72% of CFD retail investor accounts lose money trading with this provider.

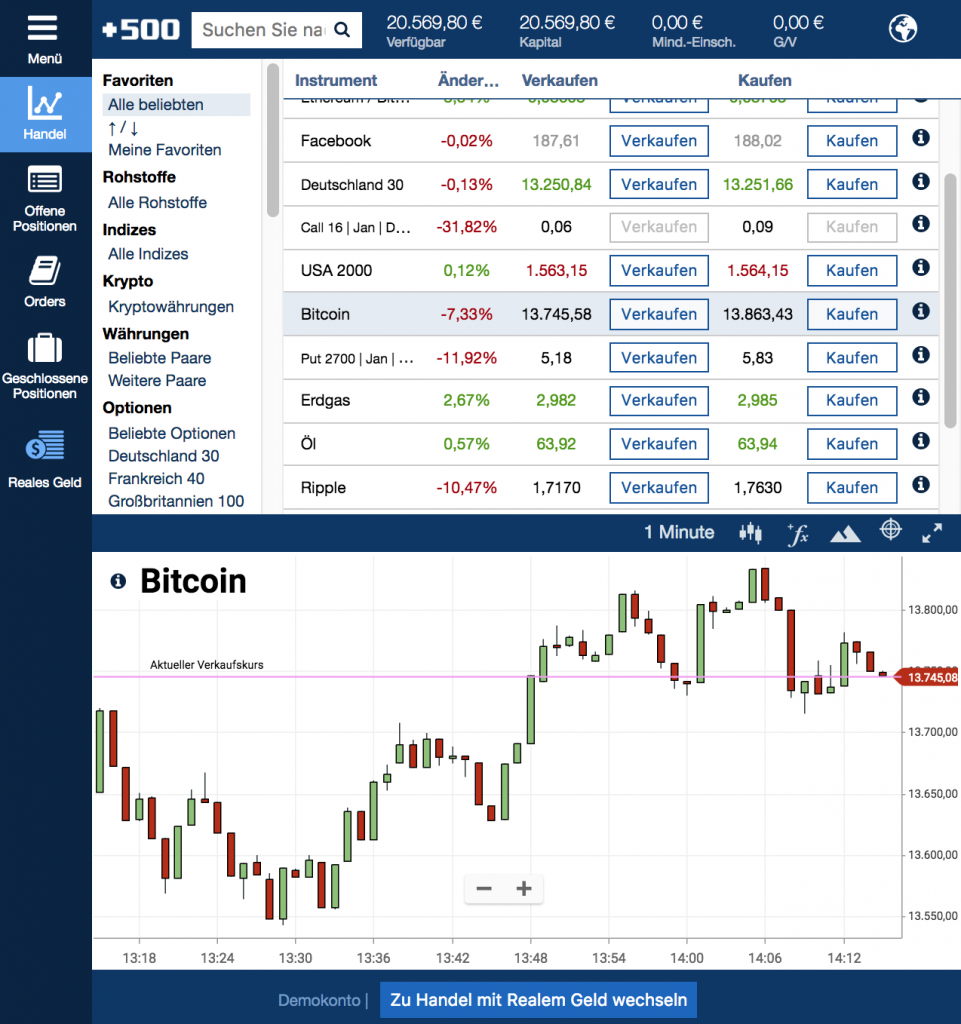

In the screenshot you can see the demo account of Plus500. Instead of offering tutorials, the platform offers trading with virtual money. Therefore, we also recommend all newbies to try out the demo account before trading with real money.

It costs nothing and you can playfully learn the Learn to trade. Je länger man mit dem virtuellem Geld handelt, desto eher bekommt man ein Gespühr fürs Trading.

Das Webinterface ist beim Demo- und Echtgeld-Konto ident. Es ist übersichtlich und auch als Einsteiger behält man den Überblick.

Tatsächlich ist es so, dass der Support bei Plus500 verbesserungswürdig ist. Wir glauben, dass auch ein Großteil der Negativbewertungen verschwinden würde, wenn man die Supportabteilung ausbauen würde, da es sich ja eigentlich um einen seriösen und empfehlenswerten Online-Trader handelt.

Abschließend lässt sich sagen, dass Plus500 eine Empfehlung Wert ist. Der Online-Broker aus Israel überzeugt mit einer riesigen Auswahl an Märkten und seriösem Handeln. Die Plattform gehört zu den erfolgreichsten in Europa. Vor allem das verfügbare Demokonto ist für Einsteiger sehr empfehlenswert. Negativ aufgefallen ist uns nur der eher mittelmäßige Support.

Trade now at Plus500!

72% of CFD retail investor accounts lose money trading with this provider.

2. eToro

eToro is also a CFD broker. However, unlike other providers, eToro is more of a social trading platform. This means that you can get insight into the trading behavior of other users and then copy their portfolios or trades.

Etoro has become known in German-speaking countries mainly because of its eye-catching advertising. The social trading platform offers trading via its own website or via a mobile app. In both variants, the social aspect is firmly integrated into the system and you can always see live how other users are trading.

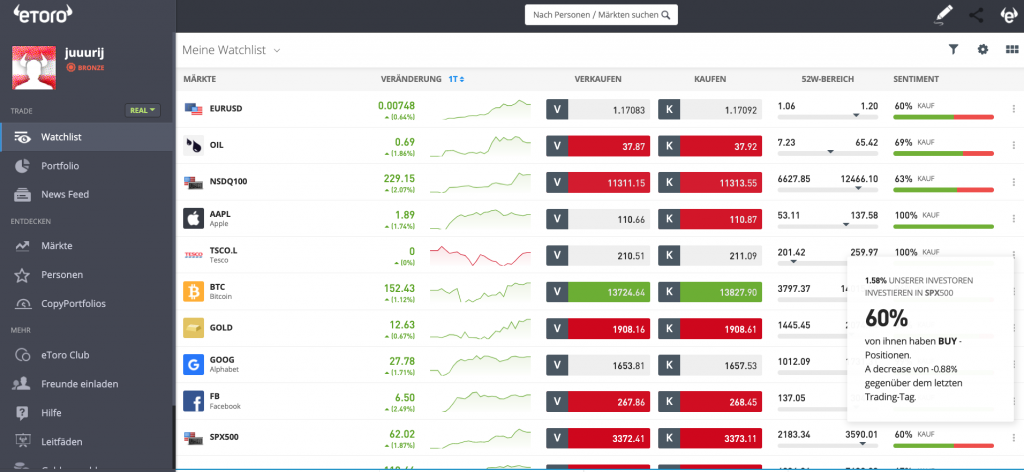

Screenshot. Sample prices. You can find current prices on the eToro platform.

Screenshot. Sample prices. You can find current prices on the eToro platform.

As you can see in the picture, the platform at eToro looks different from Plus500. In addition to the current prices for buying and selling, you can also see in the right column what percentage of users are currently selling or buying. This can be very helpful especially for beginners in trading.

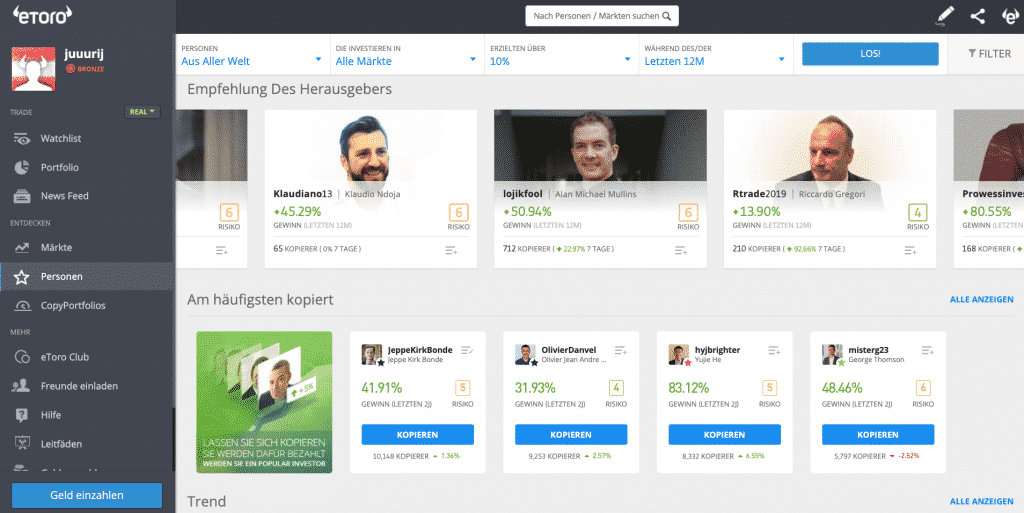

Screenshot. Sample prices. You can find current prices on the eToro platform.

Klickt man in der linken Spalte auf „Copy People“ kommt man zur Übersicht der erfolgreichsten und trending Nutzer. Klickt man auf einen Nutzer, so sieht man seinen Risk Score und seine Erfolge.

In der „Editors Choice“ Tabelle werden ausgewählte Personen näher vorgestellt. Besonders interessant: Man kann mit den erfolgreichen Investoren in Kontakt treten und sie zu zukünftigen Entwicklungen befragen.

Mit nur einem Klick auf „Copy“ kann man das Portfolio einer Person kopieren.

Was uns bei eToro außerdem sehr positiv aufgefallen ist, ist die große Anzahl an Lernmaterialien und Kursen. Neben dem Social Trading können Anfänger auch in Webinaren, e-Kursen und Blogbeiträgen das Traden lernen.

Conclusion: Unserer Meinung nach ist eToro für Einsteiger eine der besten Plattformen. Vor allem Neulinge tun sich in der Welt der Aktien oft schwer und mehr als die Hälfte verliert das investierte Geld extrem schnell. Genau diesen Trading-Missgeschicken möchte eToro mit dem Social Trading Prinzip entgegnen. Außerdem gibt es auch hier eine Demo-Funktion.

eToro is a multi-asset platform that offers investments in stocks and crypto assets as well as trading CFDs.

Please note that CFDs are complex instruments and carry a high risk of losing money quickly due to leverage. 68 % of retail investor accounts lose money trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Die Wertentwicklung in der Vergangenheit ist kein Hinweis auf zukünftige Ergebnisse. Die dargestellte Handelshistorie beträgt weniger als 5 vollständige Jahre und reicht möglicherweise nicht als Grundlage für eine Anlageentscheidung aus.

Copy Trading is a portfolio management service of eToro (Europe) Ltd. authorized and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset-Investitionen sind in einigen EU-Ländern und im Vereinigten Königreich nicht reguliert. Kein Verbraucherschutz. Ihr Kapital ist gefährdet.

eToro USA LLC bietet keine CFDs an und übernimmt keine Verantwortung für die Richtigkeit oder Vollständigkeit des Inhalts dieser Veröffentlichung, die von unserem Partner unter Verwendung öffentlich zugänglicher, nicht unternehmensspezifischer Informationen über eToro erstellt wurde.

3. flatex

![]() Die Flatex GmbH hat ihren Sitz in Deutschland und konnte bereits viele Vergleiche renommierter Handelszeitschriften gewinnen (zB. Handelsblatt: „Bester Online Broker“ oder Euro am Sonntag: „Brokerage Testsieger“).

Die Flatex GmbH hat ihren Sitz in Deutschland und konnte bereits viele Vergleiche renommierter Handelszeitschriften gewinnen (zB. Handelsblatt: „Bester Online Broker“ oder Euro am Sonntag: „Brokerage Testsieger“).

Während bei Plus500, eToro und IQ Option die Transaktionskosten über den Spread kompensiert, bzw. berechnet werden, muss man bei Flatex für jede Order mehr als 0,05% bezahlen. Die Mindestgebühr beträgt hierbei 5€ pro Order, was ziemlich hoch ist.

Conclusion: Profi-Broker für Fortgeschrittene, bei dem hohe Order-Kosten anfallen können. Wir empfehlen Flatex daher nicht für Anfänger, die erst in den CFD-Markt einsteigen.

Top 2 Alternatives: CFD Broker

1. IQ Option

Während Plus500 und eToro schon etwas länger auf dem Markt vertreten sind, ist IQ Option erst seit 2013 online. Der junge Online Broker aus Zypern ist vor allem deswegen interessant, da die Mindesteinzahlung gerademal 10€ beträgt.

Mittlerweile gibt es mehr als 80 Werte, mit denen gehandelt werden kann. Obwohl das im Vergleich mit Plus500 oder eToro eher wenig ist, reicht die Palette dabei von Rohstoffen über Devisen und Indizes bis hin zu Aktien. Seit dem Krypto-Boom sind übrigens auch Bitcoin, Ethereum, Bitcoin Cash, Ripple, IOTA und 7 weitere Kryptowährungen zum Traden verfügbar.

The website looks very modern (compared to some dusty offerings of other platforms) and the WebTrader resembles professional trading programs.

Conclusion: A recommendable online CFD broker for beginners and advanced traders. However, special CFD learning material is still missing.

2. CMC Markets

Bereits seit 1989 ist CMC Markets im Handel mit CFDs tätig. Laut Wikipedia wurden allein im Geschäftsjahr 2013 mehr als 31 Millionen Transaktionen über CMC Markets getätigt.

Wie bei Flatex fallen auch bei CMC Markets (leider) Transaktionskosten an. Für jede Orderauf Aktien CFD-s fallen 0,05% an, die Mindestgebührt beträgt auch 5€.

Conclusion: If you are familiar with charts and like professional trading software, you will love CMC Markets. Unlike the other platforms presented, this is already a more professional way to trade CFDs. Nevertheless, customers criticize the sometimes somewhat slow execution of individual orders.

What is CFD trading?

Tradet man mit CFDs, so kauft man nicht tatsächlich eine Aktie. Einfach gesagt „wettet“ man auf einen steigenden oder fallenden Kurs. Richtig gehört: Mit CFDs ist es beim Setzen einer Short-Position auch möglich, von fallenden Kursen zu profitieren.

Durch die Hebelwirkung von CFDs ist es in relativ kurzer Zeit möglich, große Gewinne (bzw. Verluste) zu erzielen.

Unser aktueller Vergleich. Regelmäßig aktualisiert.

To CFD Broker Comparison Table

Bei vielen CFD-Tradern gab es eine Nachschusspflicht, bei der der Kunde Geld nachschießen musste, wenn der Kurs sich zu stark in die nicht gewünschte Richtung bewegt hat – zB. wenn man eine Aktie geshortet hat (auf fallenden Preis getippt hat) und die Aktie stark gestiegen ist.

However, the obligation of private individuals to make additional contributions was banned by the German BaFin in August 2017, which has made trading somewhat safer. Nevertheless, there are still high risks with CFDs, as it is not always clear, especially with small platforms, whether the customer is liable and whether there is compensation in case the platform goes bankrupt.

Für alle Neueinsteiger empfehlen wir dieses Video von „Finanzfluss“. Hier wird CFD ganz genau erklärt:

Source: https://www.finanzfluss.de/was-sind-cfd/

Remember at all times that CFDs are a leveraged product and the loss of the entire capital is possible. Do not trade CFDs until you are aware of all the risks. Capital is subject to risk.